Difference Between Medicare Supplement and Advantage Plans 2026

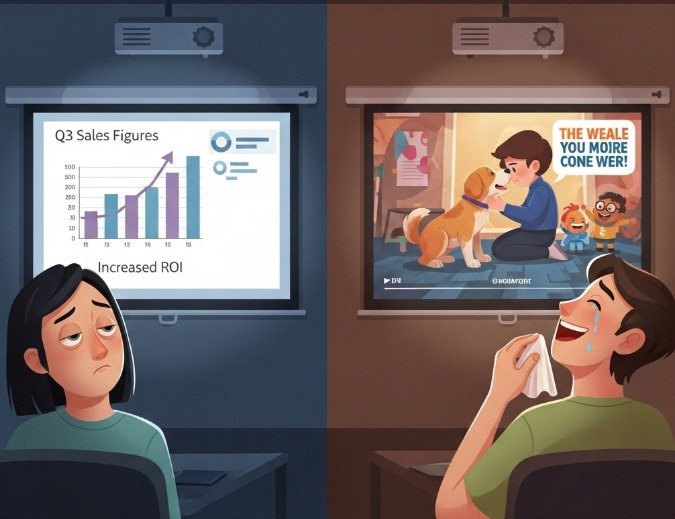

Choosing the right Medicare plan can be confusing — especially when deciding between a Medicare Supplement (Medigap) plan and a Medicare Advantage (Part C) plan.

As 2026 approaches, both options continue to evolve, offering new benefits and coverage options. Understanding the difference can help you make the right choice for your health and budget.

Let’s break it down clearly, so you can confidently explore your options at the website https://www.medisupps.com.

Medicare Supplement (Medigap) Plans 2026

Medicare Supplement plans are designed to fill the “gaps” left by Original Medicare (Parts A and B). They help cover out-of-pocket costs such as deductibles, coinsurance, and copayments. These plans are offered by private insurance companies and are standardized across most states.

In 2026, Medigap plans remain a popular choice for people who want flexibility and predictability in their healthcare spending. You can visit any doctor or hospital that accepts Medicare — no networks or referrals are needed. Once you pay your monthly premium, most of your medical costs are covered, meaning fewer surprises when bills arrive.

Medigap plans do not include prescription drug coverage, so you’ll need a separate Part D plan if you want medication benefits. However, their stability and freedom make them ideal for people who travel often or prefer to choose their doctors.

Medicare Advantage (Part C) Plans 2026

Medicare Advantage plans combine Medicare Part A (hospital) and Part B (medical) into one complete plan, offered through private insurance companies. Many Advantage plans also include Part D prescription coverage, dental, vision, hearing, and even wellness benefits — things Original Medicare doesn’t cover.

In 2026, Advantage plans are expanding their supplemental perks, such as transportation services, gym memberships, and meal delivery after hospital stays. However, these plans operate within provider networks like HMOs or PPOs, meaning you’ll likely need to use certain doctors and hospitals for full coverage.

Premiums for Advantage plans can be very low — sometimes even $0 — but costs may add up with copayments, coinsurance, and out-of-network expenses. They’re great for people who prefer bundled benefits and don’t mind staying within a provider network.

Key Differences at a Glance

- Freedom of Choice: Medigap lets you visit any doctor who accepts Medicare, while Advantage plans often limit you to specific networks.

- Cost Structure: Medigap plans have higher monthly premiums but lower out-of-pocket costs. Advantage plans have lower premiums but can result in higher expenses when you use care.

- Coverage: Advantage plans may include extras like vision, dental, and drug coverage. Medigap focuses on covering gaps in Original Medicare.

- Flexibility: Medigap works anywhere in the U.S. Advantage plans may have local or regional limitations.

Which One Is Right for You?

The choice between Medicare Supplement and Medicare Advantage depends on your lifestyle, budget, and health needs. If you value nationwide flexibility and predictable costs, Medigap might be your best option. If you prefer an all-in-one plan with extra perks and don’t mind using a network, an Advantage plan could be a better fit.

Before deciding, compare plan options and pricing at https://www.medisupps.com. The platform makes it easy to view updated 2026 rates, coverage details, and benefit comparisons — all in one place.

Final Thoughts

As 2026 brings updates to Medicare plans, taking time to understand your choices can save you money and stress. Both Medicare Supplement and Medicare Advantage plans have unique advantages. By visiting MediSupps.com, you can explore your options, compare trusted carriers, and find the coverage that fits your life best.

Disclaimer:

The information provided in this article is for general informational purposes only and should not be considered as financial, medical, or insurance advice. Medicare plans, benefits, and pricing can change annually, and individual eligibility or costs may vary by location and personal circumstances.

Readers are encouraged to verify all details directly with official Medicare sources or licensed insurance professionals before making any enrollment decisions. MediSupps.com is an independent informational platform and is not affiliated with or endorsed by the U.S. government, the Centers for Medicare & Medicaid Services (CMS), or any federal agency. Always review plan documents and consult a qualified Medicare advisor to ensure your chosen plan meets your healthcare and budget needs.